Welcome Service Region Stuttgart

We help international professionals and students to settle in the region – at the Welcome Center Stuttgart, at our consultation hours in Böblingen, Esslingen, Waiblingen, Göppingen and Ludwigsburg, or by telephone or e-mail!

We support companies in recruiting and integrating foreign professionals.

Take advantage of our free consultation service, we look forward to hearing from you and will be happy to help!

Our services for

© ebruli fotografie

© ebruli fotografie

Welcome Center Stuttgart

Are you new to the Stuttgart Region and would like personal advice? Come to the Welcome Center Stuttgart, the joint advice center of the Stuttgart Region Economic Development Corporation (with the Welcome Service Region Stuttgart) and the City of Stuttgart.

We advise international professionals and new citizens about arriving, living and working in the Stuttgart Region.

Events

Internationale Mitarbeitende und Auszubildende gewinnen – für das Handwerk aus Indien

Online-Veranstaltung: Internationale Fachkräfte beschäftigen

Sprechstunde des Welcome Service Region Stuttgart in Göppingen

Beratung für internationale Fachkräfte, Studierende und Unternehmen der Region Stuttgart

RE:THINKING – Kreislaufwirtschaft erleben

Das Pop-up Space für die Region Stuttgart vom 15. Mai bis 31. Juli 2025 - Königstraße 1A in Stuttgart

Sprechstunde des Welcome Service Region Stuttgart in Esslingen am Neckar

Beratung für internationale Fachkräfte, Studierende und Unternehmen der Region Stuttgart

Jobmesse für ausländische Fachkräfte, Auszubildende und Hilfskräfte

Arbeitgeber*innen stellen sich und ihre offenen Stellenangebote vor

Sprechstunde des Welcome Service Region Stuttgart in Ludwigsburg

Beratung für internationale Fachkräfte, Studierende und Unternehmen der Region Stuttgart

News

Fachkräfteeinwanderung: Mehr Chancen, weniger Bürokratie – wie Unternehmen profitieren

„Talente-Forum“ bei der WRS: Mit den richtigen Strategien gegen den Fachkräftemangel

Internationale Mitarbeitende und Auszubildende gewinnen – für das Handwerk aus Indien

Online-Veranstaltung: Internationale Fachkräfte beschäftigen

Sprechstunde des Welcome Service Region Stuttgart in Göppingen

Beratung für internationale Fachkräfte, Studierende und Unternehmen der Region Stuttgart

RE:THINKING – Kreislaufwirtschaft erleben

Das Pop-up Space für die Region Stuttgart vom 15. Mai bis 31. Juli 2025 - Königstraße 1A in Stuttgart

Fachkräfteeinwanderung: Mehr Chancen, weniger Bürokratie – wie Unternehmen profitieren

„Talente-Forum“ bei der WRS: Mit den richtigen Strategien gegen den Fachkräftemangel

© contrastwerkstatt – Fotolia

© contrastwerkstatt – Fotolia

Job search

Are you looking for an internship, a position for your thesis or are you looking for the right company to work for?

© Arid Ocean – stock.adobe.com / Wirtschaftsministerium

© Arid Ocean – stock.adobe.com / Wirtschaftsministerium

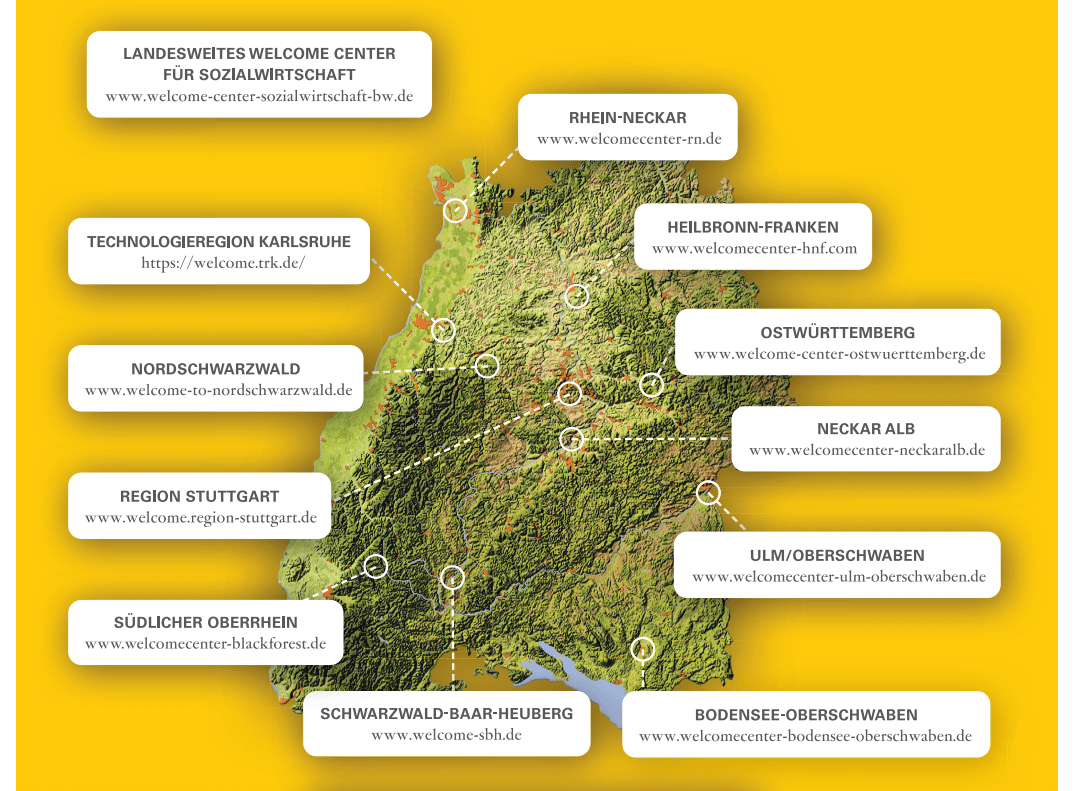

Welcome Centers in Baden-Württemberg

The Ministry of Economy, Labor and Tourism has been supporting the establishment of Welcome Centers in Baden-Württemberg since 2014.

There are currently twelve Welcome Centers in Baden-Württemberg working together across the state – eleven Welcome Centers for all professions and sectors and one Welcome Center for the social economy (for professionals in the fields of care, health and education).

Please contact the Welcome Center in your region or district you are living or willing to work.

Sponsors and supporters

The Welcome Service Region Stuttgart is offered by Stuttgart Region Economic Development Corporation (WRS), funded by the Ministry of Economy, Labor and Tourism Baden-Württemberg.

The WRS is part of the Skilled Professional Alliance Stuttgart Region. We develop our offers in close cooperation with the partners of the Alliance.